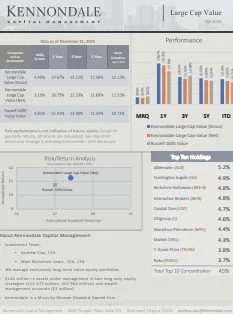

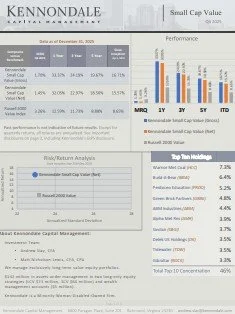

Kennondale exclusively manages long-term value equity portfolios built with fundamental analysis and conviction.

$142 Million AUM

(as of 12/31/2025)

6+ Year Track Record in Small Cap Value and Large Cap Value.

Investment Team:

Andrew Slay, CFA

Matt Nicholson-Lewis, CFA, CPA

We are located in Richmond, Virginia.

Kennondale’s Form ADV can be found HERE.

Materials

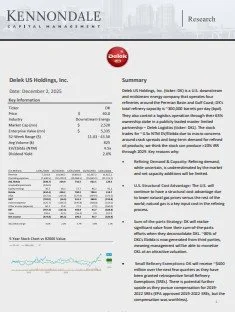

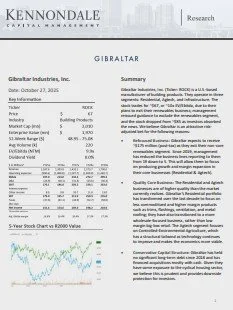

Research

We are long shares of the companies in the research pieces we shared below. Please see the full disclosures included in research pieces.

Kennondale Capital Management LLC claims compliance with the Global Investment Performance Standards (GIPS®). To receive a GIPS report, please contact info@kennondale.com. GIPS is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

Investment Team

Andrew Slay, CFA

Andrew Slay, Kennondale’s portfolio manager, has twelve years of investment experience, including managing outside capital in a private fund. He is on the board of the Sheltering Arms Foundation and serves on the foundation’s investment committee. Andrew graduated from the University of Virginia with an undergraduate degree in Economics and is a CFA® charterholder.

Matt Nicholson-Lewis, CFA, CPA

Matt Nicholson-Lewis, Kennondale’s analyst, has a background in accounting and finance, graduating with a Master of Accounting from North Carolina State University. He has ten years of experience in the financial sector, having worked at Ernst & Young in their New York and London offices, and Brink’s in their corporate headquarters in Richmond. Matt is a licensed CPA and is a CFA® charterholder.

Investment Process

Kennondale has a focused approach and manages exclusively value equity portfolios. The portfolios exhibit low turnover, high concentration, and high active share.

We apply a unique, repeatable, long-term investment process in selecting and owning businesses. Central to our process is a valuation discipline that seeks to identify companies where we see a compelling and realistic path to success over the next five years and beyond. This comprises our investment thesis, which impacts our valuation. From this, we hold portfolios where our estimates of the intrinsic values of our holdings differ materially from the market capitalizations of those businesses. We rely on our intrinsic value calculations being better, on a dollar-weighted basis, than the market’s perception of the value of those businesses.

Past performance does not guarantee future returns. An investor’s principal, when redeemed, may be worth more or less than the original investment. This website should not be construed as an offer or solicitation of an offer to buy or sell securities.

Customer Relationship Summary

Download Form CRS

A copy of Kennondale’s proxy voting record is available to clients free of charge upon request. You may also view our Form N-PX filings on the SEC’s website at https://www.sec.gov.

Kennondale is a Registered Investment Adviser. Registration with the SEC does not imply a certain level of skill or training. Our firm is authorized to provide investment advisory services only in jurisdictions where we are registered or where an exemption or exclusion from such registration is available. The content provided on this website is for informational and educational purposes only and should not be construed as personalized investment, financial, or legal advice. Please consult with a qualified professional for advice tailored to your specific circumstances.